Let’s talk about something that might sound as thrilling as a rainy day in Manchester but is actually a game-changer for your financial future: credit. Think of your credit score as your financial TikTok profile—it’s how lenders judge whether you’re legit enough to borrow money for that dream flat in Shoreditch, a new car, or even a cheeky holiday. For UK Gen Z and Millennials, building credit is like laying the foundation for your adulting empire. And guess what? Everyday stuff like utility bills, virtual mailboxes, and registering to vote can help you get there. This module dives into these hacks, plus how a solid credit score can set you up for buying property, investing, and cashing out when you’re ready for bricks and mortar. Let’s get cracking!

Why Credit is Your Financial Superpower

Your credit score is a number that tells lenders how reliable you are at paying back what you borrow. It’s based on your credit report, which tracks things like your payment history, debts, and even your address history. A good score (typically 700+ on Experian or Equifax scales) means better odds of getting approved for loans, credit cards, or mortgages, often with lower interest rates. For young adults, especially those starting with no credit history, building credit is crucial for big life moves—whether it’s renting a flat, financing a side hustle, or buying a home.

The problem? If you’re living with parents, in a shared house, or moving around a lot, you might not have the usual tools (like a credit card or loan) to build credit. That’s where utility bill hacks come in. By using bills in your name, virtual mailboxes, and voter registration, you can start establishing a credit history that makes lenders sit up and take notice.

Bills in Your Name: The Credit-Building Basics

Utility bills are the regular payments you make for essential services like electricity, gas, water, broadband, and sometimes even your mobile phone. If these bills are in your name—meaning you’re the one responsible for paying them—they can be reported to credit reference agencies like Experian, Equifax, and TransUnion. This is where they can help build your credit.

How It Works

- Credit Meters: If you have a standard credit meter for utilities (where you use the service and pay later), these accounts often appear on your credit report. Paying on time shows lenders you’re reliable, which can improve your credit score. For example, consistently paying your electricity bill could help your score climb within 6–12 months.

- Prepayment Meters: If you’re on a prepayment meter (where you pay before using the service), these typically don’t show up on your credit report because there’s no credit involved. However, you can ask your provider to switch to a credit meter, which might involve a credit check but allows you to start building credit.

- Missed Payments: Late or missed payments can hurt your score, just like missing a credit card payment. If unpaid, they could lead to defaults or county court judgments (CCJs), which stay on your report for six years. Always pay on time or contact your provider for help if you’re struggling.

Joint Accounts and Shared Living

If you share a utility bill with a flatmate or partner, it creates a financial association. This means their credit history might be considered when you apply for credit. If they’ve got a stellar record, great! But if they’re dodgy with payments, it could drag you down. Choose your bill buddies wisely. If you’re living with parents or in a shared house where bills aren’t in your name, you’re not building credit from those payments. Here’s a hack: ask to be added to the account as a named payer. This way, your payments are recorded, helping you build credit. Just ensure everyone pays their share to avoid issues.

Tips for Success

- Set Up Direct Debits: Automate payments to avoid missing due dates. Most providers, like British Gas, make this easy.

- Check Your Bills: Ensure they’re accurate to avoid overpaying or disputes. Citizens Advice has tips on claiming back credit if you’ve overpaid.

- Switch Providers: Shop around for better rates when your contract ends to save money, which you can redirect to other credit-building efforts. MoneySuperMarket can help compare deals.

- Get Help if Needed: If you’re struggling, providers often offer payment plans or hardship funds. Ocean Finance suggests contacting them early to avoid credit damage.

Pro Tip: If you’re new to the UK or young, you might have a “thin credit file” (little to no credit history). Utility bills in your name are a solid starting point to thicken that file and show lenders you’re legit.

| Utility Type | Counts as Utility Bill? | Appears on Credit Report? | Tips |

| Electricity | Yes | Yes (credit meter) | Pay on time; consider switching to credit meter |

| Gas | Yes | Yes (credit meter) | Set up Direct Debit to avoid late payments |

| Water | Yes | Yes (credit meter) | Check for discounts if on low income |

| Broadband | Yes | Sometimes | Bundle with other services for savings |

| Mobile Phone | Yes | Often (if contract-based) | Avoid missed payments; consider SIM-only deals |

| Prepayment Meter | Yes | No | Switch to credit meter if possible |

Virtual Mailboxes: A Stable Address for Credit

What if you don’t have a fixed address? Maybe you’re a digital nomad, crashing on mates’ sofas, or moving around for work. Enter virtual mailboxes—a service that gives you a physical address where your mail is received, then scanned or forwarded to you digitally. Providers like Expost or UK Postbox offer addresses recognised by banks, credit card companies, and even HMRC, making them useful for receiving financial documents.

How They Help

Virtual mailboxes provide a stable address for correspondence, which is handy if you’re applying for credit or managing bills. For example, you can have utility bills or bank statements sent to your virtual address, keeping your financial life organised. This indirectly supports credit-building by ensuring you don’t miss important notices. Some services, like Hoxton Mix, start at just £15/month, making it affordable for young adults.

The Catch

Lenders typically want a residential address, not just a mailing address, for credit applications. While virtual mailboxes are great for receiving mail, they might not be accepted as your primary residence. Always check with the lender or provider. For instance, Mailbox UK notes their address can’t be used for opening bank accounts or electoral roll registration, which limits its use for some credit purposes. If you’re using a virtual mailbox, be transparent about your living situation to avoid issues.

When to Use Them

- Nomadic Lifestyles: Perfect for digital nomads or frequent movers who need a consistent address.

- Expats or Newcomers: Helps establish a UK presence while settling in, as noted by Profee Blog.

- Organisation: Keeps your financial documents in one place, reducing the risk of missed payments.

Pro Tip: Combine a virtual mailbox with other credit-building tools, like a credit builder card, to maximise your efforts. Check provider reviews on SourceForge to find a reliable service.

Voter Registration: The Credit-Boosting Hack You Didn’t Know About

Registering to vote isn’t just about having your say in elections—it’s a secret weapon for your credit score. When you sign up, your name and address are added to the electoral roll, a public list used by credit reference agencies to verify your identity and address. This is huge because lenders need to confirm you are who you say you are to prevent fraud. Being on the electoral roll makes you look more legit, increasing your chances of getting approved for credit.

Why It Matters

- Identity Verification: Lenders use the electoral roll to check your details, as explained by Equifax UK. This can boost your creditworthiness.

- Credit Score Impact: While it doesn’t directly add points, being on the roll can improve your score indirectly by making your credit file more robust. Loqbox notes that address history is a key factor in your credit report.

- Consequences of Not Registering: Without it, you might be denied credit or face higher interest rates, per Waltham Forest Council.

How to Register

It’s dead easy: visit gov.uk, enter your details (including your National Insurance number), and you’re done in about five minutes. The electoral roll updates monthly, so allow a few weeks for your details to hit your credit file, as per Lambeth Council. If you’re not eligible to vote (e.g., non-UK residents), you can add a “Notice of Correction” to your credit file to explain why, suggests ClearScore.

Extra Perks

- Legal Requirement: In the UK, registering to vote is mandatory, and skipping it could lead to a £1,000 fine, per Equifax UK.

- Quick Win: It’s one of the fastest ways to boost your credit profile, especially for young people or new UK residents.

Fun Fact: Up to 7.5 million eligible voters aren’t on the electoral roll, missing out on this credit boost. Don’t be one of them—register today!

Financing the Purchase, Investment Potential, and Resaleability

Building credit with utility bills, virtual mailboxes, and voter registration isn’t just about small wins—it’s about setting yourself up for big financial goals, like buying a home. A strong credit score opens doors to better financing options, makes property a viable investment, and ensures you can cash out profitably when you’re ready to move on. Here’s how it all connects.

Financing the Purchase

A good credit score is your golden ticket to securing a mortgage. Lenders look at your score to decide if you’re a safe bet and what interest rate to offer. With a higher score (say, 700+), you’re more likely to get approved and snag a lower rate. For example, a 1% lower rate on a £200,000 mortgage could save you £30,000 over 25 years, per general mortgage calculations. That’s serious cash you could use for renovations, travel, or investing.

- Mortgage Options: Good credit unlocks access to fixed-rate, variable-rate, or first-time buyer mortgages. Check deals on MoneySuperMarket.

- Lower Deposits: Some lenders offer low-deposit mortgages (e.g., 5%) to those with strong credit, making homeownership more accessible.

- Alternative Financing: If a mortgage isn’t an option, good credit can help you get personal loans or guarantor loans to fund a deposit or other costs.

Hack: Use a credit builder card alongside these methods to further boost your score, as suggested by MoneySavingExpert.

Investment Potential

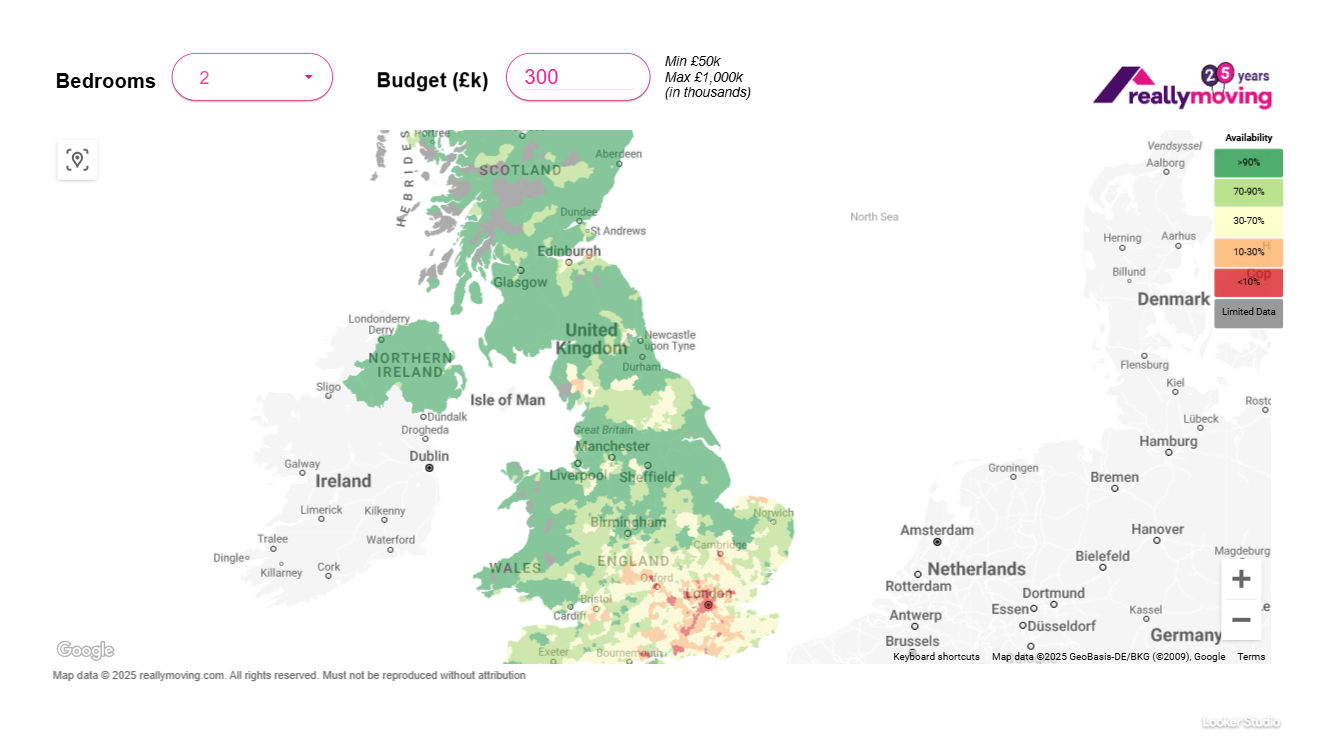

Property isn’t just a place to crash—it’s a potential money-maker. With good credit, you can finance a home that appreciates over time. UK property prices have historically risen, though past performance isn’t a guarantee. For instance, a flat bought in a growing area like Manchester could be worth more in 10 years. You can also rent out your property (or a room) for passive income, especially in high-demand cities.

- Buy-to-Let: Good credit makes it easier to get a buy-to-let mortgage, letting you invest in rental properties. Ocean Finance suggests using savings from utility bill hacks to fund such investments.

- Renovations: Invest in upgrades (like a modern kitchen) to increase your property’s value.

- Diversification: Use mortgage savings to invest in other assets, like stocks or ISAs, though always weigh the risks.

Reality Check: Property investment comes with risks—market dips, maintenance costs, and taxes can eat into profits. Research thoroughly and consider advice from Citizens Advice.

Resaleability: Cashing Out for Bricks and Mortar

When you’re ready to sell your property, a strong credit score ensures you can finance your next move, whether it’s upgrading to a bigger home or cashing out for other goals. The resale value of your property depends on several factors:

- Location: Properties in desirable areas (e.g., near good schools or transport links) sell for more.

- Condition: A well-maintained home with modern features (like energy-efficient windows) attracts higher offers.

- Market Trends: Timing your sale during a seller’s market can boost profits, though this is unpredictable.

- Amenities: Proximity to shops, parks, or trendy cafes can make your property more appealing.

To maximise resale value, keep your property in top shape and consider small upgrades before selling. List on platforms like Rightmove or through a local estate agent for maximum exposure. The money from the sale can fund your next property purchase, helping you climb the housing ladder.

Pro Tip: Use your credit-building skills to maintain financial discipline, ensuring you’re ready for the costs of buying and selling property, like stamp duty or legal fees.

Wrap it Up

Building credit might not be as glamorous as scrolling through Insta, but it’s just as important for your future. By putting utility bills in your name, using virtual mailboxes to stay organised, and registering to vote, you’re laying the groundwork for a strong credit score. And that score? It’s your key to financing a home, investing in property, and selling it for a profit when the time comes. So, take control of your financial rep—your future self will be proper chuffed.

Key Takeaway: Credit is like your financial CV. The better it looks, the more opportunities you’ll get. Start small with utility bills, add a virtual mailbox if you need to, and don’t skip voter registration. It’s all about playing the long game for that bricks-and-mortar dream.

Key Points

- Utility bills in your name with credit meters can help build credit if paid on time, but missed payments may harm your score.

- Virtual mailboxes provide a stable address for receiving financial documents, though lenders may require a residential address for credit applications.

- Voter registration boosts credit by verifying your identity and address, making it easier to get approved for loans or credit cards.

- Good credit enhances your ability to finance property purchases, invest in real estate, and sell property profitably, but building credit requires consistent effort.

- Evidence suggests these methods are effective, though their impact varies based on individual circumstances and lender policies.