Tiny Homes 101

If you are dreaming of owning a brick-and-mortar home but feeling crushed by sky-high house prices, tiny homes could be a viable option to financial freedom and a sustainable lifestyle. These compact, eco-friendly dwellings are more than just a trend—they’re a movement that lets you live big while keeping your budget small. In this module, we’ll break down UK planning laws, how to build a tiny home on a £10,000–£30,000 budget, and the ins and outs of off-grid systems. We’ll also explore container homes and futuristic space capsule homes as innovative alternatives. Plus, we’ll examine how a tiny home can be a smart investment to help you save for that forever home. Let’s explore!

Why Tiny Homes?

Tiny homes are small (typically 200–400 square feet/19-37 square meters), self-contained properties designed for minimalist, sustainable living. They’re perfect if you want to:

- Slash living costs and avoid hefty mortgages.

- Live eco-consciously with a smaller carbon footprint.

- Gain flexibility to move or travel without being tied down.

- Save serious cash for your future brick-and-mortar home.

In the UK, where the average house price is around £290,000, tiny homes offer a budget-friendly alternative, costing as little as £10,000 to build yourself or £30,000 for a prebuilt model. They’re a savvy way to live affordably while stacking your savings.

UK Planning Laws: Navigating the Rules

Before you start sketching your dream tiny home, you need to understand UK planning laws. Don’t worry—it’s not as daunting as it sounds! Tiny homes, especially those on wheels (THOWs), are often classified as caravans under the Caravan Sites and Control of Development Act 1960, which can make things easier. Here’s the lowdown:

Where Can You Put a Tiny Home?

- In Your Garden: If your tiny home is within the “curtilage” (the enclosed land around your main house) and doesn’t exceed 19.8m x 6.7m (65ft x 22ft), you usually don’t need planning permission, as long as it’s used as “additional living space” (e.g., a home office or guest room) rather than a separate dwelling.

- On Private Land: If you’re buying or renting land for a permanent tiny home, you’ll likely need planning permission, just like for a regular house.

- Caravan Sites or Glamping Sites: Tiny homes on wheels can be placed on caravan sites or glamping sites (with permission) without planning hassles, ideal for holiday lets or temporary stays.

- Farm Land: There’s a grey area where tiny homes can be classed as dwellings for farmers or workers under “Permitted Development” rights, but always check with your local planning officer.

Key Legal Considerations

- Road Legality: If your tiny home is on wheels, it must be no wider than 2.55m and 7m long to be road-legal on a standard driving licence. For larger homes, you’ll need a C1E licence to tow up to 12,000kg.

- Council Tax: If your tiny home is your primary residence, you’ll likely need to pay council tax. If it’s a secondary dwelling (e.g., in your garden or a holiday home), you’re usually exempt.

- Building Regulations: Tiny homes must meet UK building standards for safety, energy efficiency, and durability, whether on wheels or stationary.

Council Tax for Tiny Homes and Space Homes in the UK

The rules for council tax on tiny homes in the UK are similar to those for boats in some respects but depend heavily on the classification, location, and use of the tiny home. For space homes (a less-defined term, often referring to innovative, futuristic, or off-grid modular homes), the rules are less clear due to their novelty, but I’ll address both based on available information and analogies to similar structures like tiny homes or caravans. Below is a breakdown:

Tiny Homes

Tiny homes in the UK are often classified as caravans or permanent dwellings depending on their mobility, size, and how they’re used. Council tax liability hinges on these factors:

- Permanent Residence on Private Land:

- If your tiny home is your main or sole residence and is permanently fixed on private land (e.g., rented or purchased land), you will likely have to pay council tax. It’s treated as a permanent dwelling under the Local Government Finance Act 1992, typically falling into Band A (the lowest council tax band) due to its small size and modest valuation based on April 1991 property values.

- You must inform the local council if you move your tiny home to private land and declare it as your residence, as this triggers council tax liability.

- Additional Living Space (e.g., in a Garden):

- If the tiny home is within the curtilage (e.g., back garden) of your main residence, is no larger than 19.8m x 6.7m (65ft x 22ft), and is used as additional living space by household members (e.g., like a granny annex or office), you don’t have to pay additional council tax. The main dwelling’s council tax covers it, as it’s not considered a separate dwelling.

- Key conditions: It must not be rented out or used as a standalone residence, and it must remain within the property’s legal boundaries (curtilage). If moved outside the curtilage or used as a separate dwelling, council tax may apply.

- Holiday or Secondary Home:

- If the incomplete tiny home is used as a holiday home or secondary residence (not your main home), you generally don’t pay council tax, provided your primary residence is elsewhere and already taxed.

- However, from April 2025, councils in England can impose a second home premium of up to 100% (doubling the council tax bill) on second homes that are “substantially furnished” and not a main residence. This could apply to tiny homes used as second homes, depending on local council policies. Check with your local authority, as around 75% of English councils plan to implement this.

- Mobile Tiny Homes (Caravan Classification):

- If your tiny home is mobile (e.g., on a trailer, no larger than 2.55m wide and 7m long for road legality with a standard driving license), it’s legally classified as a caravan. If parked temporarily (e.g., for up to 28 days) or moved regularly, you typically don’t pay council tax, similar to continuous cruising on a boat.

- If parked permanently on a caravan park or residential site with planning permission, you may still owe council tax if it’s your main residence, often at Band A.

- Exemptions and Discounts:

- Tiny homes may qualify for exemptions if they’re uninhabitable (e.g., under major repairs) or classified as mobile homes with no fixed address. Off-grid tiny homes with minimal utilities (e.g., no mains electricity, water, or sewage) may sometimes fall into lower bands or qualify for discounts, but this varies by council.

- Single-occupancy discounts (25%) or low-income exemptions may apply if you’re the sole resident or on a low income. Contact your local council to confirm eligibility.

- Grey Areas and Local Variations:

- There’s ambiguity around curtilage on farmland or rural properties, where a tiny home might be classified as a dwelling for agricultural workers under Permitted Development rules. Always consult your local planning officer to clarify.

- Council tax rates and enforcement vary by local authority. Urban areas with high housing demand often have higher rates, while rural areas may have lower bands. Always check with your local council, as verbal agreements can be unreliable—get everything in writing.

Space Capsule Homes

The term “space capsule home” isn’t well-defined in UK law or the provided sources, but it likely refers to innovative, futuristic, or off-grid modular homes (e.g., prefabricated pods, eco-friendly micro-homes, or structures designed for extreme environments). Since there’s no specific legislation for “space homes,” they’re likely treated similarly to tiny homes, caravans, or permanent dwellings based on their characteristics. Here’s an analysis:

- Permanent Dwelling:

- If a space home is a fixed structure on land (e.g., a modular pod with foundations, connected to utilities), it’s likely classified as a permanent dwelling and subject to council tax, typically at Band A due to its small size. The Valuation Office Agency (VOA) would assess its value based on 1991 property values.

- Planning permission and building regulations compliance are required, which could affect tax liability if the structure is deemed a primary residence.

- Mobile or Temporary Structure:

- If the space home is mobile or temporary (e.g., a portable pod or off-grid unit moved regularly), it may be treated like a caravan, potentially exempt from council tax if not used as a main residence or permanently fixed. This aligns with rules for mobile tiny homes or continuous cruising boats.

- If parked in a garden as additional living space (within curtilage, not rented out), it may avoid council tax, similar to a tiny home annex.

- Off-Grid or Experimental Homes:

- Off-grid space homes (e.g., with solar panels, composting toilets, or water tanks) might qualify for lower council tax bands or exemptions if they lack standard utilities, but this depends on the council’s assessment. Some councils may still classify them as dwellings if used as a primary residence.

- If the space home is part of a holiday let or secondary residence, it could be exempt from council tax unless the second home premium applies (from April 2025).

- Unique Considerations:

- Space homes designed for extreme environments (e.g., inspired by space habitats) may face additional scrutiny under building regulations for safety, energy efficiency, and accessibility. If they don’t meet these standards, they might be deemed uninhabitable, potentially exempting them from council tax temporarily.

- If a space home is part of a community project or tiny home village, council tax could apply per unit unless the site is classified as a business (e.g., a holiday park), in which case business rates might apply instead.

- Lack of Precedent:

- Since “space homes” are a niche concept, there’s little legal precedent. You’d need to consult your local planning office and the Valuation Office Agency to determine how your specific structure is classified. Provide detailed specifications (e.g., size, mobility, utilities, and intended use) to get accurate guidance.

Key Takeaways and Recommendations

- Tiny Homes:

- Pay council tax if it’s your main residence on private land (likely Band A).

- Exempt if used as additional living space in a garden (within curtilage, not rented out) or as a holiday home (unless the second home premium applies).

- Mobile tiny homes may avoid tax if moved regularly, like continuous cruising boats.

- Always check with your local council, as rules vary, and get agreements in writing.

- Space Capsule Homes:

- Likely treated as tiny homes or caravans depending on mobility and use.

- Council tax applies if a permanent dwelling; exemptions possible if mobile, off-grid, or temporary.

- Due to their novelty, consult local authorities and provide detailed specs to clarify tax liability.

- General Advice:

- Contact your local council and the Valuation Office Agency to confirm your property’s status and tax band.

- Be aware of the second home premium starting April 2025, which could double council tax for non-primary residences in many areas.

- Keep records (e.g., utility bills, mooring/land agreements) to support your case if disputes arise.

- For both tiny homes and space homes, planning permission and building regulations compliance are critical to avoid fines or reclassification, which could affect tax status.

If you have specific details about your tiny home or space home (e.g., size, location, mobility, or intended use), I can tailor the answer further. Let me know!

| Scenario | Planning Permission Needed? | Council Tax? |

|---|---|---|

| Garden (additional living space) | No (if <19.8m x 6.7m) | No |

| Permanent residence on private land | Yes | Yes |

| Caravan/glamping site | No (if site-approved) | No (if secondary) |

| Farm land (Permitted Development) | Maybe (check with council) | Maybe |

Container Homes: Affordable and Industrial Chic

Container homes, built from repurposed shipping containers, are a popular subset of tiny homes, combining affordability, durability, and a modern industrial aesthetic. They’re an excellent option for those seeking a sustainable, budget-friendly home that’s quicker to construct than traditional builds. Here’s everything you need to know about container homes in the UK:

Why Choose a Container Home?

- Cost-Effective: A single 20ft or 40ft shipping container can be purchased for £2,000–£5,000 (used) or £5,000–£8,000 (new), making them a low-cost base for a tiny home.

- Durability: Built to withstand harsh marine environments, steel shipping containers are robust, weather-resistant, and long-lasting.

- Sustainability: Repurposing containers reduces waste and the demand for new building materials, lowering your carbon footprint.

- Modularity: Containers can be stacked or combined to create larger homes, offering flexibility for future expansion.

- Quick Build: With pre-existing structures, container homes can be completed in weeks rather than months, ideal for those on a tight timeline.

UK Planning and Legal Considerations

Container homes are treated as permanent dwellings in most cases, as they’re typically fixed to the ground with foundations. Here’s how they fit into UK regulations:

- Planning Permission: Required for container homes on private land, as they’re considered permanent structures. If placed in your garden as additional living space (within curtilage, not a separate dwelling), permission may not be needed, but check with your local council.

- Building Regulations: Must comply with UK standards for insulation, ventilation, fire safety, and structural integrity. Containers often require significant insulation (e.g., spray foam, £1,500–£3,000 per container) to meet energy efficiency rules.

- Council Tax: If used as a primary residence, container homes fall into Band A for council tax due to their small size. If used as a secondary structure (e.g., garden office), they’re typically exempt, similar to tiny homes.

- Road Legality: If designed as a mobile unit (e.g., on a trailer), they may be classified as caravans, potentially avoiding planning permission on approved sites, but this is rare due to their weight and size.

Building a Container Home

- Cost Breakdown:

- Container Purchase: £2,000–£8,000 per container (20ft or 40ft).

- Conversion Costs: £10,000–£25,000 for insulation, windows, doors, plumbing, and electrical work. DIY conversions can lower costs to £5,000–£10,000.

- Foundation: £1,000–£3,000 for concrete piers or a slab foundation.

- Off-Grid Systems: £6,000–£12,000 for solar, water, and waste systems.

- Total: £15,000–£35,000 for a single-container home; multi-container setups may reach £50,000.

- Design Tips:

- Insulation: Essential to prevent condensation and regulate temperature. Spray foam or rigid foam boards are common, with costs varying by container size.

- Windows and Doors: Cutting openings for natural light improves livability but requires professional welding (£500–£2,000).

- Interior: Use multi-functional furniture (e.g., Murphy beds, foldable tables) to maximize the narrow space (8ft wide for standard containers).

- Cladding: Exterior cladding (e.g., wood or metal panels, £2,000–£5,000) enhances aesthetics and weatherproofing.

- Suppliers: Companies like Container City and Koto Design offer pre-converted containers or bespoke designs starting at £25,000. Used containers can be sourced from ports or online marketplaces like eBay or Container Sales UK.

Off-Grid Container Homes

Containers are well-suited for off-grid living due to their compact size and durability:

- Solar Power: Roof-mounted solar panels (1,500-watt system, £5,000–£8,000) fit easily on flat container roofs.

- Water Systems: Rainwater harvesting tanks (£500–£1,000) can be tucked beside or beneath the container. Composting toilets (£300–£600) eliminate sewage needs.

- Heating: Wood burners or propane heaters (£500–£2,000) work well in small container spaces but require ventilation for safety.

Investment and Resale Potential

- Holiday Lets: Container homes are popular for Airbnb or glamping, with unique designs fetching £100–£150 per night, potentially earning £25,000–£35,000 annually at 75% occupancy.

- Resale Value: Well-maintained container homes hold value better than custom tiny homes due to their standardized design, with used units reselling for £15,000–£30,000 depending on condition and upgrades.

- Challenges: Resale markets are niche, and poor insulation or corrosion can lower value. Regular maintenance (e.g., rust-proofing, £200–£500 annually) is key.

Real-Life Example

Sarah converted a 40ft container into a one-bedroom home for £22,000, including £3,000 for the container, £12,000 for conversion (insulation, windows, plumbing), and £7,000 for solar panels and a rainwater system. She rents it on Airbnb for £120 per night, earning £28,000 annually while living off-grid.

| Component | Cost Range | Key Consideration |

|---|---|---|

| Container Purchase | £2,000–£8,000 | Used vs. new containers |

| Conversion (Insulation, Windows, Plumbing) | £5,000–£25,000 | DIY vs. professional work |

| Foundation | £1,000–£3,000 | Required for fixed setups |

| Off-Grid Systems (Solar, Water, Waste) | £6,000–£12,000 | Ideal for remote locations |

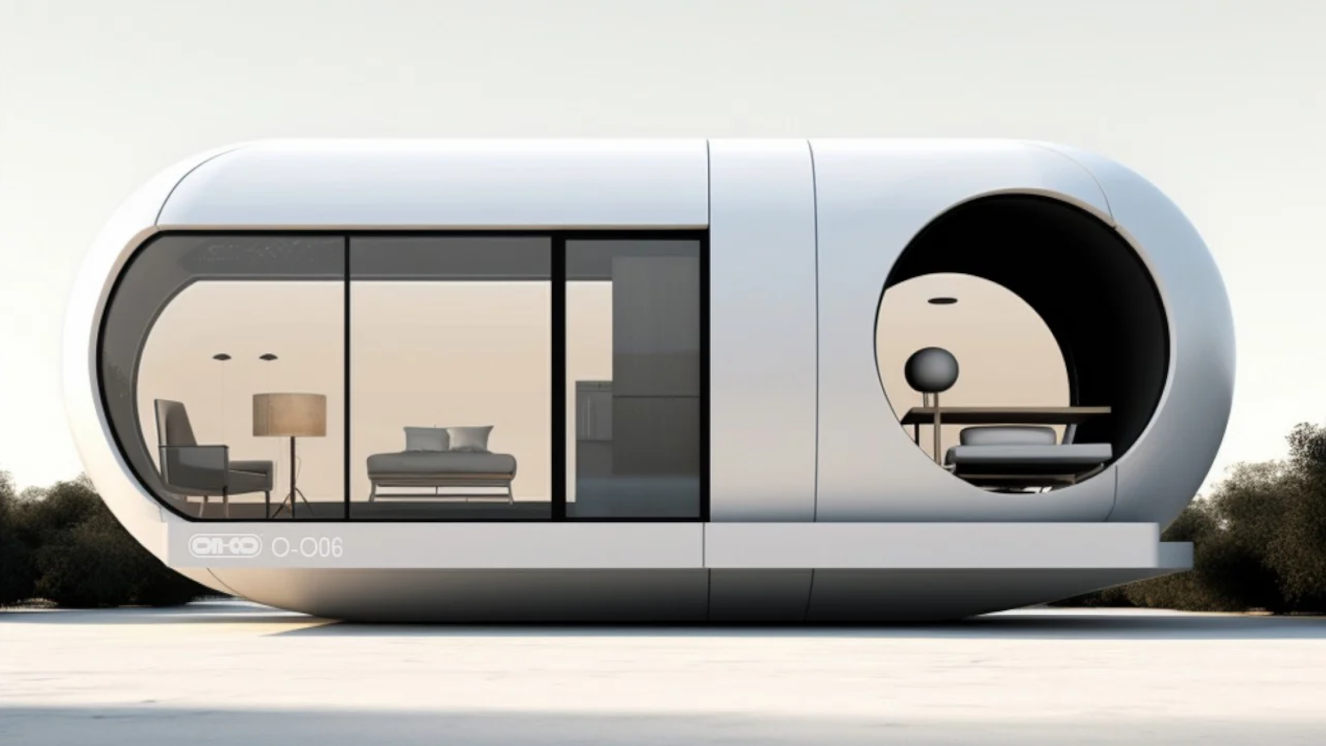

Space Capsule Homes: Futuristic Living

Space capsule homes, inspired by sci-fi aesthetics and space habitat technology, are cutting-edge, prefabricated micro-homes designed for efficiency, sustainability, and extreme environments. Often modular, off-grid, and highly technological, they’re a niche but growing option in the UK tiny home market. Here’s the full scoop:

Why Choose a Space Capsule Home?

- Futuristic Design: Sleek, aerodynamic shapes and high-tech interiors appeal to those wanting a unique, modern home.

- Extreme Efficiency: Designed for minimal resource use, with integrated systems for power, water, and waste, ideal for off-grid living.

- Portability: Many are mobile or semi-mobile, allowing placement in remote or unconventional locations.

- Sustainability: Built with eco-friendly materials and advanced insulation, they minimize environmental impact.

- Compact Footprint: Typically 100–300 square feet, they’re smaller than many tiny homes, perfect for solo dwellers or couples.

UK Planning and Legal Considerations

Space capsule homes are a grey area in UK law due to their novelty, but they’re generally classified as either caravans (if mobile) or permanent dwellings (if fixed). Key points:

- Planning Permission: Required for fixed space homes on private land, similar to container homes. Mobile units may qualify as caravans if under 2.55m wide and 7m long, potentially avoiding permission on approved sites or as temporary structures.

- Building Regulations: Must meet standards for safety, insulation, and accessibility. Their unconventional materials (e.g., fibreglass or composites) may require extra certification, adding £1,000–£3,000 in compliance costs.

- Council Tax: As primary residences, they’re likely Band A. If used as secondary structures (e.g., garden pods) or moved regularly, they may be exempt, like mobile tiny homes. The second home premium (from April 2025) could apply to non-primary residences.

- Unique Challenges: Their futuristic designs may raise concerns with planning officers about aesthetics or environmental impact. Provide detailed specs (e.g., materials, utilities) to local councils for clarity.

Building a Space Capsule Home

- Cost Breakdown:

- Base Unit: Prefabricated pods (e.g., from Ecocapsule or Harwyn Pods) cost £30,000–£80,000, depending on tech and size.

- Customisation: Adding smart home systems (e.g., automated lighting, climate control) or advanced off-grid tech (e.g., solar-integrated roofs) adds £5,000–£15,000.

- Foundation or Transport: Fixed units need foundations (£1,000–£3,000); mobile units require trailers or cranes (£2,000–£5,000 for transport).

- Off-Grid Systems: £6,500–£15,000 for integrated solar, water recycling, and waste systems.

- Total: £35,000–£100,000, with DIY or simpler models closer to £35,000.

- Design Tips:

- Integrated Systems: Many capsules come with built-in solar panels, water recycling, and composting toilets, reducing setup costs.

- Materials: Often use lightweight composites or fibreglass, which are durable but expensive to repair if damaged.

- Space Optimization: Built-in storage and foldable furniture are standard, maximizing tiny interiors.

- Aesthetics: Prioritize sleek, minimalist designs to maintain the futuristic appeal, but ensure compliance with UK building codes.

Off-Grid Space Capsule Homes

Space capsules are designed for off-grid living, often including:

- Power: Integrated solar panels or micro-wind turbines (£5,000–£10,000) power compact interiors. Lithium-ion batteries store energy for continuous use.

- Water: Advanced greywater recycling and rainwater harvesting systems (£1,000–£3,000) are built-in, with compact tanks fitting the pod’s design.

- Waste: High-tech composting or incinerating toilets (£500–£1,500) eliminate sewage needs, ideal for remote locations.

- Heating/Cooling: Efficient heat pumps or infrared heaters (£1,000–£2,500) maintain comfort in small spaces.

Investment and Resale Potential

- Holiday Lets: Their unique design makes space capsules highly marketable for glamping or Airbnb, fetching £150–£250 per night, potentially earning £40,000–£60,000 annually at 75% occupancy.

- Resale Value: Limited market due to their niche appeal, but high-quality units from recognized brands (e.g., Ecocapsule) can retain 70–90% of value if well-maintained. Custom or experimental designs may have lower resale value.

- Challenges: High initial costs and lack of widespread recognition in the UK can limit resale. Focus on reputable manufacturers and versatile designs to improve marketability.

Real-Life Example

James purchased an Ecocapsule for £65,000, including built-in solar panels, water recycling, and a composting toilet. Placed on a rented rural plot, it serves as his primary residence with no council tax (classified as a caravan due to mobility). He spends £300 annually on maintenance and earns £45,000 yearly renting it out part-time on Airbnb.

| Component | Cost Range | Key Consideration |

|---|---|---|

| Base Unit | £30,000–£80,000 | Brand and tech level |

| Customisation (Smart Systems, Off-Grid Tech) | £5,000–£15,000 | Enhances functionality |

| Foundation or Transport | £1,000–£5,000 | Fixed vs. mobile setup |

| Off-Grid Systems (Solar, Water, Waste) | £6,500–£15,000 | Built-in for efficiency |

Building on a Budget: £10,000–£30,000

You don’t need a massive bank account to build a tiny home. With careful planning, you can create a cosy, functional space for £10,000–£30,000. Here’s how:

Cost Breakdown

- DIY Build: A self-built tiny home can cost as little as £10,000–£15,000 if you’re handy and use affordable materials like reclaimed wood or flat-pack kits (e.g., Tiny House UK’s 12-foot kit for £6,500).

- Prebuilt Homes: Prefabricated tiny homes from companies like Tiny ECO Homes UK range from £30,000 for a basic model to £55,000 for a deluxe two-bedroom version.

- Shells/Kits: For those with some DIY skills, a tiny home shell (the basic structure) costs £10,000–£15,000, letting you customise the interior to your taste.

Budget-Saving Tips

- Prioritise Essentials: Focus on insulation, plumbing, and structural integrity before splurging on fancy fittings.

- Use Sustainable Materials: Opt for reclaimed timber or shipping containers (starting at £12,000) for a modern, eco-friendly atmosphere.

- Multi-Functional Furniture: Invest in foldable beds or storage-integrated seating to maximise space without breaking the bank.

- Avoid Over-Customisation: Stick to tried-and-tested designs to keep costs down, as small changes in tiny spaces can lead to big expenses.

| Build Type | Cost Range | Best For |

|---|---|---|

| DIY Build | £10,000–£15,000 | Hands-on folks with construction skills |

| Shell/Kit | £10,000–£15,000 | DIYers who want a head start |

| Prebuilt | £30,000–£55,000 | Those wanting a move-in-ready home |

Real-Life Example

Tom and his partner built a tiny home for £18,000, adding £8,000 for a solar energy system and £4,000 for land rental and moving costs. They now spend just £200–£300 a year on gas and £100 a month on rent, saving thousands compared to traditional housing.

Off-Grid Systems: Sustainable and Savvy

Going off-grid isn’t just for eco-warriors—it’s a practical way to cut bills and live sustainably while saving for your brick-and-mortar home. Here’s how to set up an off-grid tiny home:

Power

- Solar Panels: A 1,500-watt solar system with batteries and an inverter costs around £5,000–£8,000 and can power lights, appliances, and heating. Roof-mounted panels are ideal for mobility.

- Wind Turbines: Useful in windy areas but pricier (starting at £10,000) and less common for single tiny homes.

- Batteries: Invest in high-quality solar batteries (e.g., 110ah) to store energy for cloudy days. Factor in space for battery storage in your design.

Water

- Rainwater Harvesting: Legal in the UK, this involves collecting rainwater in tanks (starting at £500) with a pump for pressure. Ensure plumbing meets building regulations.

- Water Tanks: A holding tank (similar in size to a combi boiler) costs £200–£500 and can be hidden in a cupboard. Hybrid systems let you fill from the mains for flexibility.

- Grey Water Recycling: Legal with approval, this reuses water from sinks for non-potable needs, costing £1,000–£2,000 to install.

Waste

- Composting Toilets: Eco-friendly and low-maintenance, models like EcoFlo cost £300–£600 and don’t require sewage connections.

- Drainage: Simple drainage systems for grey water (e.g., to a soakaway) cost £500–£1,000 and must comply with local regulations.

Heating

- Wood Burners: Affordable (£500–£1,500) and effective for small spaces, they add cosy atmospheres but need constant supervision.

- Propane Heaters: Direct-vent propane heaters (£800–£2,000) are thermostat-controlled and ideal for off-grid living, though tanks need refilling.

| System | Cost | Key Benefit |

|---|---|---|

| Solar Panels | £5,000–£8,000 | Flexible, eco-friendly power |

| Rainwater Harvesting | £500–£1,000 | Sustainable water source |

| Composting Toilet | £300–£600 | No sewage connection needed |

| Wood Burner | £500–£1,500 | Cosy, low-cost heating |

Tip: Work with specialists (e.g., Tiny House Pro) to install off-grid systems, as DIY errors can be costly. Always check local regulations for utilities.

Financing, Investment Potential, and Resaleability

A tiny home isn’t just a place to live—it’s a financial pathway to your brick-and-mortar dream. Here’s how to make it work:

Financing Options

- Personal Loans: Many banks offer personal loans for tiny homes, especially if they’re classified as caravans. For example, a £30,000 loan over 5 years is manageable for a couple with stable income.

- Commercial Loans: Since mortgages aren’t available for tiny homes (they lack foundations), commercial loans are an option for financing prebuilt models or kits.

- Eco-Friendly Lenders: Organisations like Ecology Building Society specialise in funding sustainable builds, offering competitive rates for tiny homes.

Investment Potential

- Holiday Lets: Tiny homes on glamping sites or Airbnb can generate significant income. A single tiny home at £120 per night with 75% occupancy can earn £30,000+ annually.

- Low Running Costs: With off-grid systems, you’ll save £780–£1,057 a month compared to traditional homes, freeing up cash for savings or investments.

- Community Models: Joining an eco-village (like BedZED in London) can involve shared costs and revenue from energy or compost sales, boosting your financial returns.

Resaleability

- Limited Second-Hand Market: The UK’s tiny home market is small, so resale values are less predictable than traditional homes. However, well-maintained prebuilt homes (e.g., from Tiny ECO Homes UK) can fetch close to their original price if barely used.

- Custom Builds: DIY or heavily customised tiny homes may have lower resale value due to niche appeal, so stick to versatile designs if resale is a goal.

- Timing: As the tiny home movement grows (only 200 official tiny homes in the UK vs. 10,000 in the US), demand may increase, potentially boosting resale values in the future.

Tip: Document your build process and maintenance to reassure buyers. A road-legal, high-quality tiny home with off-grid features is more likely to retain value.es, connect with tiny home builders, and crunch your budget. Your future self (and your bank account) will thank you!

Tiny House Legality & UK Laws

- Understanding UK Laws for Tiny Houses (2023)

Covers planning permission, road legality for towable homes, and council tax rules, with input from industry experts 1. - Are Tiny Houses Legal? Planning Permission Guide

Explains caravan classifications, garden placement rules, and when planning permission is required 8. - Understanding The UK Laws of a Tiny House

Details size/weight limits for mobile homes and permitted development rights for static units 2. - Everything About Tiny House UK Law (Tiny House Builders)

Comprehensive guide on legal definitions, site fees, and utility connections for permanent dwellings.

Eco-Villages & Case Studies

- BedZED: Pioneering Eco-Village Story

How the UK’s first zero-carbon community achieved 45% lower energy use and 81% less hot water consumption 310. - East Whins Eco-Village

Community-led project in Scotland using local materials and cohousing principles 5.

Building Guides & Housing Solutions

- Journal: Building a Tiny House (UK) – Part 4

Personal account of construction challenges, insulation choices, and legal hurdles 9. - £50k Eco-Tiny Homes for UK Housing Crisis

Examines prefabricated models as affordable alternatives, with cost comparisons 7.

Additional Resources

- The Legalities of Tiny House Living (Medium)

Discusses grey areas in planning law and real-world enforcement experiences 8. - Tiny Home Planning Permission and UK Law

Focuses on agricultural land use, temporary placements, and glamping site regulations.